Archive: September 2007

Bush-Aznar transcript in El País

September 26, 2007

[Via Josh Marshall's Talking Points Memo] The Spanish daily El País has obtained the transcript of a private conversation between President Bush and then-president of Spain, Jose Maria Aznar, on February 22, 2003, during the final run-up to invasion of Iraq.

For me the most striking impression is how lucid, relaxed, and confident President Bush sounds. The transcript may have been tidied up, but he speaks in full sentences and full paragraphs, something he rarely does in public, unless he is reading from a prepared text.

I may write more later, but for now I want to highlight one point. Early on in the conversation President Bush tells President Aznar that, according to Egyptian sources (and apparently with some independent corroboration from Gaddafi in Lybia), Saddam Hussein would be prepared to go into exile if he were allowed to take $1 billion with him, as well as, as Bush put it "...all the information he [Hussein] would like on the weapons of mass destruction." (Presumably, the documents Saddam Hussein would need to cover his tracks and his ass.)

So, for $1 billion, we could have averted the Iraq War? Why wasn't that a serious, publicly debated, option on the table? Since we didn't have the imagination to envision this option or to take it seriously, hundreds of thousands of people have died, we're on our way to spending a half a trillion dollars, probably a trillion before all is said and done, Iraq is in a civil war, and now we're staring at another possible war with Iran. Who thinks that those would not have been $1 billion well spent?

Demand for Economist Bloggers

September 20, 2007

Yesterday, Dani Rodrik ran an online straw poll of which economist his readers would most like to see take up blogging. Well, the results are in. In first: Nobel Prize winner Joseph Stiglitz. A close second: John Bates Clark medal winner Daron Acemoglu.

Dos Amigos?

September 20, 2007

According to a story in yesterday's Washington Post, in his forthcoming autobiography, former Mexican president Vicente Fox calls President Bush: "...'the cockiest guy I have ever met in my life' and a 'windshield cowboy' afraid to ride a powerful horse."

Meeeeoow, pardner.

Guy Outsources Own Job

September 19, 2007

I had lunch yesterday with an economist friend who is writing a book on globalization. We spent some time talking about the politics and economics of "outsourcing" and "offshoring" and I mentioned to him an almost certainly apocryphal story I heard back in 2004.

As the story is told, a US-based computer programmer wrote a post on geek-site Slashdot announcing: "About a year ago I hired a developer in India to do my job. I pay him $12,000 out of the $67,000 I get. He's happy to have the work. I'm happy that I have to work only 90 minutes a day just supervising the code. My employer thinks I'm telecommuting. Now I'm considering getting a second job and doing the same thing."

I've searched Slashdot's archives and haven't found the original post. The source, rather, seems to be a story in the India Times in July 2004. (Let me know if you have any evidence that a Slashdot post does exist.)

Whether this act of outsourcing ever really happened or not is irrelevant. The story illustrates an essential aspect of globalization (and technological change, too). Our relationship to the process, not nearly so much the process itself, is what overwhelmingly determines our attitudes.

If US workers "owned" their jobs, and could do what this programmer claims to have done (albeit, surreptiously), I think most of the US work force would be vocal supporters of outsourcing.

In the economy we live in, however, firms "own" the jobs and pocket all the benefits of outsourcing (except any resulting price declines for consumer products --which are a fairly small compensation for your lost job, health insurance, and pension).

In standard trade theory, the gains to the owners of the firm are sufficient to compensate the losses to the firm's workers. In practice --in the United States, at least-- the winners in globalization (or technological progress) actively resist sharing any benefits of globalization with the losers. I take this as evidence that the benefits of globalization are probably substantially smaller than proponents claim. If the benefits were large, there would be plenty of money to make a deal with the losers.

One last point. In the example here, the US programmer comes across as pretty clever. At the same time, I find myself judging the guy (I'm guessing that the likely fictitious programmer is a guy) for exploiting his Indian counterpart, especially, when the US programmer announces the idea of getting another job and hiring another Indian programmer. (Until that point, I saw the US programmer as, fundamentally, a peace-loving slacker. When he wants to sign up for another job, he suddenly sounds greedy.) Sure, the Indian programmer is happy to be earning $12,000, but it is purely an accident of birth that lets the US programmer net $55,000 a year from the deal for working 90 minutes a day, while the Indian programmer makes $12,000 a year for working what is presumably something like a full-time job. (I'm leaving aside that it is much cheaper to live in India than it is to live in the United States, let alone Northern California.) The arrangement essentially personalizes the exploitation of the Indian programmer, and I find it interesting that I react viscerally to that in a way that I don't when it is a US software company doing the same thing --and screwing a US programmer, to boot.

Bubble Trouble

September 19, 2007

The current issue of The Nation has an excellent piece on the bursting of the housing bubble by my friend (and boss), Dean Baker. Dean spells out how we got in the mess we're in and suggests a few things we can do to ease the pain a bit.

For those of you trying to figure out what to do with your retirement savings, Dean makes an interesting aside. "When it comes to recessions, the professionals seem to be the last to find out: On the eve of the last downturn, in the fall of 2000, all the Blue Chip 50 forecasters predicted solid growth for the following year."

Kicking Ass in Anbar

September 18, 2007

General Petraeus and President Bush both made a lot last week of military and political progress in Anbar province.

Meanwhile, Gary Langer, director of polling at ABC News, had an excellent op-ed in the New York Times on Sunday describing what that success looks like:

In a survey conducted Aug. 17-24 for ABC News, the BBC and NHK, the Japanese broadcaster, among a random national sample of 2,212 Iraqis, 72 percent in Anbar expressed no confidence whatsoever in United States forces. Seventy-six percent said the United States should withdraw now --up from 49 percent when we polled there in March, and far above the national average.

Withdrawal timetable aside, every Anbar respondent in our survey opposed the presence of American forces in Iraq --69 percent "strongly" so. Every Anbar respondent called attacks on coalition forces "acceptable," far more than anywhere else in the country. All called the United States-led invasion wrong, including 68 percent who called it "absolutely wrong."

No residents of Anbar who participated in the survey --no one-- supported the US presence in Iraq. One hundred percent of Anbar residents --every single one-- said it was "acceptable" to attack US forces. Does that ever happen in surveys? Unanimous opposition to the US presence. Unanimous agreement that it is acceptable to attack US forces. And this is the place the President Bush and General Petraeus say we are making progress.

Can someone in the press ask President Bush for a reaction?

(Best news of the week so far is that the New York Times has abandoned Times Select, so I can now link to stories in the NYT.)

Dow Soars, So Do Foreclosures

September 18, 2007

The Dow Jones Industrial Average jumped 335 points --about 2.5 percent-- today after the Fed announced its decision to cut the federal funds rate a half point (from 5.25 percent to 4.75 percent).

The Fed did the right thing. If Fed Chair Ben Bernanke wanted to bolster his anti-inflation credentials --at the expense of the economy-- he could have cut the rate only a quarter point, or even kept the benchmark rate unchanged.

Unfortunately, even the Fed's fairly forceful action hardly leaves us out of the woods. The other big story today was that home foreclosures more than doubled in August relative to their number a year earlier. Total foreclosures were up 36 percent just between July and August.

The number of foreclosures is actually pretty staggering. If we can believe the numbers produced by Realty Trac Inc., the source of today's foreclosure stories, we've had about 1.35 million foreclosures between January and August of this year. By comparison, over the same period the US economy has only generated about 708,000 jobs. So far in 2007, we've had almost twice as many home foreclosures as new jobs.

Ubuntu on Thinkpad X60s

September 17, 2007

Ben Zipperer has a great page on running Ubuntu 7.04 on a Thinkpad X60s (exactly my configuration).

Backyard Briefing

September 17, 2007

My friend, DH, called my attention to a useful new blog: Backyard Briefing ("News from the rest of America"), run by British journalist Ben Whitford.

The site provides a nice daily (weekdays) review of the US (and sometimes, UK) papers' coverage of Latin America.

For years I've been looking for a site that does a similar review of Latin American newspapers or the papers in a particular Latin American country. If you know of any, please let me know at without [dot] motive at g m a i l [dot] com.

Right to Drive

September 17, 2007

The Associated Press reports today that women in US-ally Saudi Arabia are organizing to demand the right to drive.

One of the leaders of the newly formed Committee of Demanders of Women's Right to Drive Cars declared: "We would like to remind officials that this is, as many have said, a social and not religious or political issue. And since it's a social issue, we have the right to lobby for it." You know, because women in Saudi Arabia don't have the right to lobby on religious or political issues.

The AP concluded, however, that: "The government is not likely to respond to the plea because the issue is so sensitive and divisive."

I thought one of the reasons we invaded Afghanistan --in addition to capturing OBL dead or alive-- was to free women from the oppressive rule of the Taliban. I know that Mrs. Bush was very worked up about the issue at the time. Maybe Mrs. Bush just doesn't know that women are not allowed to drive in Saudi Arabia?

Greenspan: Iraq is About Oil

September 16, 2007

If you didn't read Bob Woodward's piece in Friday's Washington Post all the way through to the fifth-from-the-bottom paragraph, you would have missed this astonishing quote from Alan Greenspan's new tell-all book: "I am saddened that it is politically inconvenient to acknowledge what everyone knows: the Iraq war is largely about oil."

Wow. Will someone please ask President Bush to comment on The Maestro's take on the war?

Michael Lewis

September 12, 2007

A friend's email today reminded me that Michael Lewis is writing some of the best commentary out there on the state of the US financial markets. Lewis's last two columns for Bloomberg are worthy of the Daily Show: A Wall Street Trader Draws Some Subprime Lessons (September 5) and A Wall Street Trader Learns Some Taxing Lessons (September 12).

The first piece is so dry that some overworked and underpaid anti-poverty advocates in Washington initially thought the piece was for real. Maybe kinda the way that some far rightwingers' first impression might be that Stephen Colbert should be on Fox, instead of languishing away on some obscure cable TV station.

"I Don't Know"

September 11, 2007

After really letting me down yesterday, General David Petraeus today almost made me think that there is a chance that we might get out of Iraq in my lifetime.

Under questioning from Senator John Warner (Republican, Virginia), in a moment of remarkable candor, General Petraeus --the commander of the Multinational Forces in Iraq, President Bush's man in Baghdad-- told the American people that he doesn't know whether the more than 3,000 troops and going on a half-a-trillion dollars we've dedicated so far to Iraq is actually making America safer.

Warner's question sets a remarkably low bar: is what we are doing "making America safer"? Not: "Do you believe that this is the best way to spend 3,000 lives and a half-a-trillion dollars?" Just: is what you are doing "making America safer?" And the guy in charge doesn't know whether that is the case.

Here's the transcript:

WARNER: I hope in the recesses of your heart that you know that strategy will continue the casualties, stress on our forces, stress on military families, stress on all Americans. Are you able to say at this time, if we continue what you have laid before the Congress, this strategy, that if you continue, you are making America safer?

PETRAEUS: Sir, I believe that this is indeed the best course of action to achieve our objections in Iraq.

WARNER: Does that make America safer?

PETRAEUS: Sir, I don't know actually. I have not sat down and sorted out in my own mind. What I have focused on and been riveted on is how to accomplish the mission of the Multinational Force in Iraq.

And here's the video, courtesy of YouTube:

Globalization and Wages

September 11, 2007

The Economic Policy Institute's Josh Bivens has an interesting and pessimistic new paper on "Globalization, American Wages, and Inequality" [pdf].

Among other things, the paper updates a simple model developed by Paul Krugman back in 1995 to look at the effects of trade on wages. Back when Krugman published the model and his related empirical findings, the goal was to demonstrate that the small share of trade with low-wage countries meant that globalization couldn't possibly be having much impact on US workers' wages. Josh, who notes that trade with low-wage countries has expanded considerably since 1995, now finds that the same model suggests that the inflation-adjusted wages of roughly the bottom three-fourths of the US workforce have fallen about four percent as a result of import competition from low-wage countries.

A key point here is that these effects are not confined to manufacturing or other workers in direct competition with low-wage workers (call-center workers, for example). The magic of the market ensures that the effects of job losses spread throughout the economy. Workers that lose their jobs in manufacturing look for work in services. The extra supply of workers looking for service-sector jobs then drives down the wages there, too.

The paper also includes a nice table summarizing a wide range of estimates of the current and future number of jobs vulnerable to outsourcing. (See his Table 2.)

Surgin' General

September 10, 2007

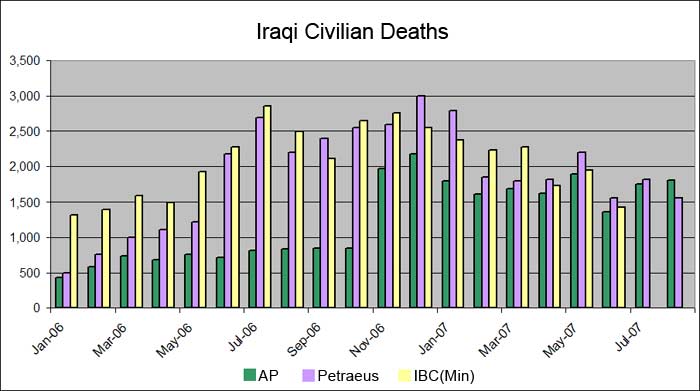

I really hope I'm wrong, but my first take is that the Bush Administration got a lot of aid and comfort today from General Petraeus. He certainly conveyed the idea that the United States is making military progress on the ground in Iraq, and offered at least one metric to support his view: Iraqi civilian deaths are down since the surge started.

The funny thing is that the evidence and the methodolgy that General Petraeus uses to support his claim all appear to be classified. Meanwhile, Spencer Ackerman of Talking Points Memo, has assembled data from two independent sources --the Associated Press, and Iraqi Body Count-- and finds almost the exact opposite.

The graph below, from TPM, compares the independent AP and IBC counts, to the data General Petraeus presented today. (Click the graph for a larger version.)

A few observations about the chart. First, according to AP (green bars), Iraqi civilian deaths have been higher in every month in 2007 than they were in the same month in 2006. Second, the same is true for the IBC data (yellow bars --the IBC reports a minimum and a maximum range, the data here are the IBC minimum), except for June, which experienced a decline in 2007 relative to 2006. (IBC data for July and August are not yet available.) Finally, the general's numbers (purple bars) show no distinct downward trend after a sharp drop between December 2006 and January 2007 --before the surge got under way.

(Thanks to Dean Baker for suggesting the title of this post!)

International Gambling

September 6, 2007

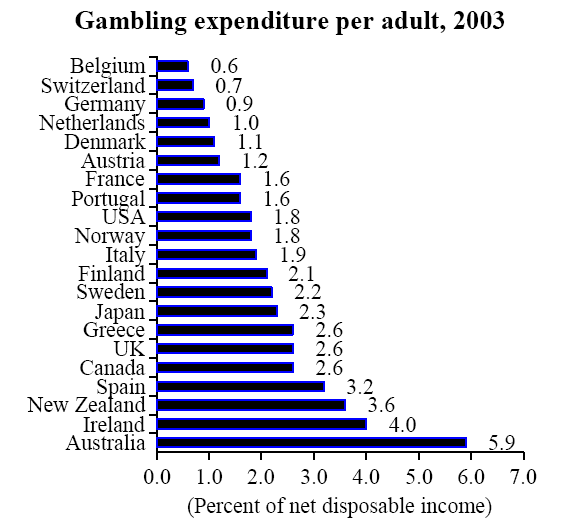

Economist Frederic Pryor of Swarthmore College, has a new "Note on Gambling in Industrialized Nations," which includes some estimates of total gambling expenditures per adult, expressed as share of each countries' net disposable income (basically, after-tax income).

Apparently, speaking English and gambling go hand-in-hand. Five of the top six gamblingest countries are English-speaking (Australia, Ireland, New Zealand, Canada, and the United Kingdom --of course, they speak French in Canada, too). The United States, though, was way down the list at 13th.

The underlying data, from Global Betting and Gaming Consultants, have their problems, which Pryor discusses, but they show Australians spending an astonishing 5.9 percent of their net disposable income on gambling. In the United States, we keep it to just 1.8 percent, which still strikes me as pretty high: basically, by Pryor's calculations, Americans, on average, gamble away just under one work-week of their earnings per year.

Hail, Caesar!

September 6, 2007

Via Dan Froomkin's White House Briefing:

"Doug Conway writes for the Australian Associated Press that Bush brought to Australia "not one Jumbo jet, but three, as well as another two aircraft that carry aircraft. The President's Jumbo has a back-up, and the back-up has a back-up. . . .

"The Jumbos are carrying 700 of the President's closest friends, including a doctor, nurse, personal chef and four cooks. . . .

"His entourage includes 50 White House political aides, 150 national security advisers and 200 specialists from other government departments."

Here's the link to Conway's story.

Economists, World Domination

September 5, 2007

Anil Hira of the Political Science Department at Simon Frasier University in Canada has written a paper called "Should Economists Rule the World? Trends and Implications of Leadership Patterns in the Developing World, 1960-2005." I haven't read the piece, which appears in the current issue of the International Political Science Review, but here are a few lines from the abstract:

"The article presents a database on the qualifications of leaders of the world's major countries over the past four decades. The article finds that while there is evidence for increasing "technification," there are also distinct and persistent historical patterns among Asian, African, Middle Eastern, and Latin American leaders. Using statistical analysis, the article finds that we cannot conclude that leadership training in economics leads to better economic outcomes."

Labor Day

September 3, 2007

In honor of Labor Day in the United States, CEPR released a paper that Margy Waller, Shawn Fremstad, Ben Zipperer and I have written on "Unions and Wage Mobility for Low-Wage Workers".

The paper argues that our efforts to improve the standard of living of low-wage workers focus too much on "improving" low-wage workers and not nearly enough on improving low-wage jobs themselves. A large share of low-wage workers are adults who have already completed their formal education and remain in low-wage jobs for extended periods of time. While moving low-wage workers up and out of what are currently low-wage jobs is an admirable goal, a lot of what are currently low-wage jobs will be with the economy in large numbers for a long time to come (cashiers, child-care workers, teachers assistants, restaurant workers, etc.) A strategy based solely on educating and training people for better jobs ignores the reality that even if we were able to give everyone a college degree, we'd still have a lot of jobs that currently offer poor wages, benefits, and working conditions.

One solution we promote in this paper is to facilitate unionization of low-wage work. We show that even in the lowest-paying jobs in the country, when workers are unionized, wages and benefits are substantially better than when they are non-union. Among the 15 low-wage occupations we examined, the average wage for unionized workers was about $1.75 per hour higher than it was for non-union workers. We also found that unionized workers were about 25 percentage-points more likely than otherwise identical non-union workers were to have employer-provided health insurance and a pension.

Cult of personality

September 3, 2007

Today is the last day of MaxSpeak, You Listen!, one of my favorite blogs covering economics and politics. Max Sawicky of EPI started the blog a few years back and, with help from a small roster of like-minded people, built it into one of the most important economics blogs on the web.

Rumor has it that Max will be starting a new job in Washington for an employer that frowns upon its employees' running blogs with political commentary. The MaxSpeak crew, minus Max, will continue to blog at a new location: Econospeak ("Annals of the Economically Incorrect").

So, how to make up for the loss of MaxSpeak? First, I remind you of some fine left-of-center economics blogs that I've been reading every day for quite some time, including Dean Baker's Beat the Press and Brad DeLong's Grasping Reality with Both Hands. Second, I've added two new economics-focused blogs to my links page: Angry Bear ("Slightly left of center economic commentary on news, politics, and the economy") and Dani Rodrik ("Unconventional thoughts on economic development and globalization"). And two new politics pages: Ezra Klein ("Tomorrow's media conspiracy today") and Matthew Yglesias ("A Reality-Based Weblog"). Finally, you can check out the content at: CEPR (where I work), EPI (where Max and I both used to work), and Inclusion ("Independent Progressive New").

If you have any other suggestions, please email me at without [dot] motive [at] g m a i l [dot] com.

Own to Rent

September 1, 2007

Today's papers are full of coverage of President Bush's announcement yesterday of measures to ease the growing problems in the "subprime" lending market. Among other things, Bush proposed to use "jawboning" to encourage lenders to allow homeowners at risk of defaulting on their mortgages to renegotiate better terms. Probably the most important measure Bush proposed would give homeowners that manage to negotiate partial loan forgiveness special tax treatment. (Under current law, the portion of the loan that is forgiven counts as income and can be taxed.)

My CEPR colleague Dean Baker has come up with a much better idea, and, to the amazement of some, his proposal has already received endorsements from at least two prominent conservative economists. Dean's idea, spelled out in a recent op-ed in The Providence Journal co-authored with conservative economist Andrew Samwick, proposes legislation to grant:

"...homeowners the right to stay in their homes as long as they like, simply by paying the fair-market rent. In other words, no one gets tossed out on the street, as long as they can pay the rental value of their house. The fair rent would be determined by an independent appraiser — exactly the same way that a lender is supposed to determine the size of a mortgage that can be issued on a home.

"Under this plan, homeowners would turn over their property to the mortgage holder. This would generally not be a loss since borrowers currently face crises precisely because they owe more than the value of their house. If the value of the home exceeded their debt, then they wouldn’t have to sign up for the program.

"As a renter with secure tenure, the former homeowner would have incentive to do necessary maintenance and keep the home from falling into disrepair. This would prevent the blight that is already hitting neighborhoods where foreclosures have become commonplace.

"The mortgage holder would get possession of the house, but they would be stuck having the former homeowner as a tenant. Otherwise the mortgage holder is free to hold or sell the property as they choose. Being stuck with a renter may reduce the resale value of the house, but intelligent investors knew there was risk when they got into the business.

"To limit the size of the program and to ensure that it only benefits those who are really in need, there can be a cap placed on the value of homes that qualify. For example, Congress could stipulate that only homes with a market value below the median price for an area are eligible for this plan.

"This security-of-housing proposal meets the needs of the homeowners who were victimized by deceptive lending practices and pro-homeownership ideologues. It gives them the right to stay in their home as long as they want. It accomplishes this task in a way that provides minimal opportunities for fraud and should require very little by way of new government bureaucracy.

"It also manages to benefit homeowners in crisis without also rescuing the financial institutions that were speculating in mortgages gone bad. This will give the presidential candidates, and other members of Congress, a clear choice between helping distressed homeowners or bailing out financial institutions that should have known better."

Harvard economist and former chair of President Bush's Council of Economic Advisors, Greg Mankiw, yesterday endorsed the "Baker-Samwick" plan.

President Bush's comments yesterday, however, seemed to distance himself from anything along these lines: "It's not the government's job to bail out speculators or those who made the decision to buy a home they knew they could never afford." Probably only President Bush thinks that the victims of subprime lending "knew" that they could not afford the houses they were buying.

Readers commenting on Mankiw's blog page, most of whom definitely seem to be right of center, were also surprisingly critical of the "Baker-Samwick" plan. Their arguments ranged from the purely ideological ("markets must be left to adjust" independent of the human cost) to the self-interested (now these houses won't go on the market at fire-sale prices for me to scoop up). What seems to be missing from the analysis made by the more ideological commenters I read is any understanding that what will likely happen is a bailout of the lending institutions with the former homeowners left out on the street.